Does Elon Care About Crypto?

14 years after the first mention of Bitcoin, Twitter is the most important web2 social platform for crypto. But Twitter and crypto are stuck in an awkward relationship.

Twitter and crypto have always had an awkward relationship. The crypto community loves talking on Twitter, but Twitter leadership doesn’t seem to care.

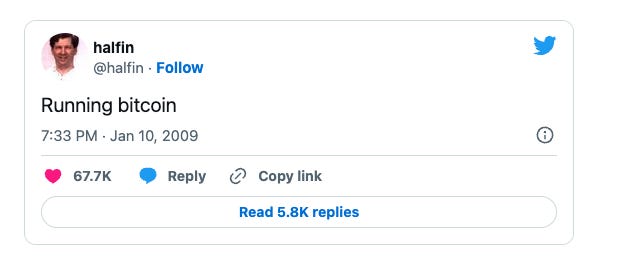

Twitter has been the most important distribution channel for crypto since the early days of Bitcoin, with the first mention coming from Hal Finney on January 10th, 2009.

Hal famously received the first Bitcoin transaction from Satoshi, and is one of the first contributors to Bitcoin code. His first tweet simply said “Running bitcoin” and is now legendary in OG Bitcoin circles:

Hal’s tweet was published during the Evan Williams Twitter era (2008-2010), shortly after Jack Dorsey’s first term as CEO (2006-2008).

14 years later and many CEOs later (Dick Costolo, Jack Dorsey 2nd term, Parag Agrawal, Elon Musk), the Twitter product doesn’t take crypto or web3 seriously.

Talk to insiders and they will confirm that current Twitter leadership under Elon Musk does not care about crypto, as it relates to their core product. There is no judgement from this author - product roadmaps are complicated - it’s just reality.

Until about 2 years ago, Twitter seemed to ignore that a multi-trillion dollar industry relied on their platform for everyday communication.

That changed during the last bull market as Twitter built a crypto team internally in 2021 led by Tess Rinearson. The team has reportedly been disbanded and Rinearson left the company in November 2022.

Still, Twitter’s inability to respond to the crypto community on a product level is surprising for anybody who followed Twitter’s public market performance before they became a private company under Elon.

Twitter’s stock struggled since its $26 public listing in November 2013, and the company never figured out how to expand beyond advertising revenue despite the growth of subscriptions (and yes, crypto) at other consumer internet properties.

When I led revenue at Tinder, I was invited to Twitter in 2017 by a senior product executive for a friendly visit where we spoke about adding subscriptions to the product.

This was during “Jack Dorsey, Term 2” - and as we ate a fancy lunch, the senior product executive told me that Jack would never allow subscriptions on the platform because he believed that all information needed to be free.

I do not claim to know every consideration of the Twitter roadmap at the time, but the business model stubbornness was shocking to me because it was clear at Tinder that consumers will pay for subscriptions if you create unique value or access.

5% of active Tinder users were paying subscribers and we were approaching $1b+ in direct recurring revenue, and Twitter had a much larger monthly active user base.

Why would a struggling public consumer internet company not consider subscriptions?

I sometimes wonder if Twitter would be owned by Elon today had they taken direct revenue and subscriptions more seriously in 2017.

Which brings me to crypto and web3.

A potential monetization opportunity for Twitter to explore would have been crypto and web3, especially during the 2017 bull run.

But life in 2017 was complicated for all consumer internet companies, including Facebook and Twitter.

Both platforms were under congressional scrutiny about their role in Russia's possible interference in the 2016 election.

Twitter also struggled at the time with spam and abuse problems because of Jack’s focus on free speech.

The main product priorities were making Twitter a platform for healthy discussions and improving performance and usability in emerging markets like the Middle East and Latin America (non-US, European, and Asian countries).

Adding crypto and payments to a platform with spam and abuse issues would have added fraud and risk at moment when Twitter was already fragile.

There have always been rumors about Twitter product releases that might utilize crypto for mainstream adoption, but no new products have moved the needle.

It is 2023 and the Twitter product is still in an awkward relationship with crypto, even though the majority of crypto social discourse happens on CT (Crypto Twitter).

Twitter is the place where alpha is discovered and where NFT owners can change their profile pictures to verified digital apes, but the company generates no direct revenue from crypto or web3.

So why doesn’t Crypto Twitter leave Twitter altogether? Or find a product that will embrace the community in a more direct way?

In the fall, I wrote about how many founders are experimenting with go-to-market launches on more crypto friendly platforms like Farcaster - read: “Farcaster: The New Crypto GTM”.

The truth is that distribution matters, and Twitter still owns distribution.

New consumer social products will chip away at the value of crypto Twitter, but that will take many years and Twitter doesn’t feel threatened.

But Twitter does need direct revenue. So why not embrace being the most important web2 consumer platform for crypto and web3, or it least pretend to care?

Under Elon, there is continued hope that Twitter will become a crypto friendly company (he loves the $DOGE), but early monetization is focused on subscriptions.

This is the right priority in a bear market, but their revenue roadmap needs more creativity or a better Twitter Blue.

If you talk to smart people who understand web2 and web3, the clear crypto monetization opportunity is a focus on NFTs and crypto trading. But neither appear to be on the roadmap.

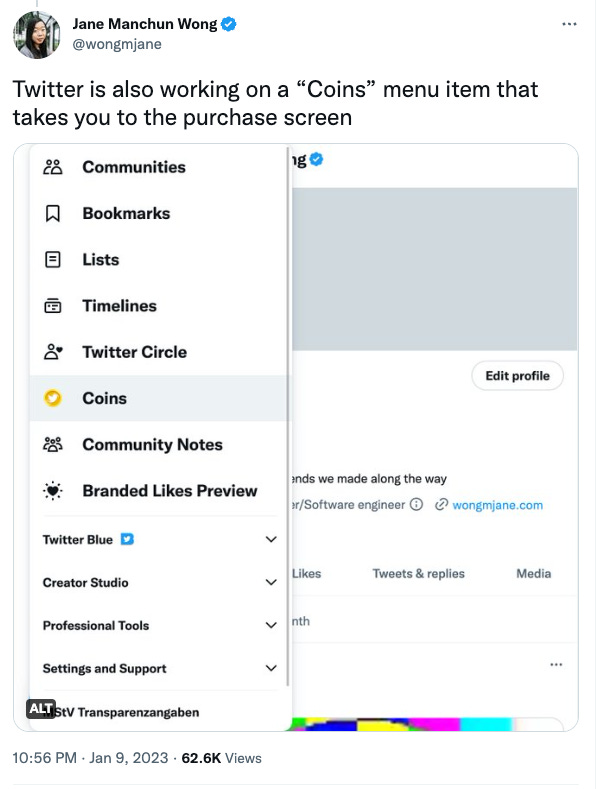

Last week, it was announced that Twitter is working on a feature called Coins, which will allow users to support creators on the platform.

Twitter Coins will be purchased via Stripe on the web who do accept crypto as a payment, but this is a product feature for creators, not a crypto product.

In April 2022, Stripe tested a product feature that let a select group of creators receive their payouts in USD Coin (USDC) a stablecoin tied to the US Dollar.

For Twitter Coins, consumers will likely never interact with USDC when purchasing and sending coins to creators.

It’s possible that USDC can help power payouts, but most creator focused products we speak to say that creators prefer good old fashioned fiat, so the actual crypto will be abstracted away.

On the web, Twitter recently launched a minor feature that can drive more crypto utility. If you search for a coin or public stock by its ticker, you are given a price chart and a deeplink leading to purchase the asset.

As an example, I ran a search for The Graph ($GRT) on Twitter web and was given a price chart for The Graph and a link leading to Robinhood.

To be clear, this feature also applies to public market searches like Amazon ($AMZN), so again, so this isn’t explicitly a crypto product feature.

While business details of the partnership are not known, the Robinhood link will have no material impact on direct revenue at Twitter and is an experiment that won’t win any revenue or growth trophies for product managers.

Robinhood has 14 million monthly active users, compared to Twitter’s 450 million monthly active users, so only a small part of Twitter can even even use the feature without signing up for a new service.

There is likely overlap with CT (crypto twitter) having Robinhood accounts, but the integration won’t impact Twitter in a major way.

Elon will get more desperate to find direct revenue in 2023 as the first installments of his “looming interest payments” for $13B of debt are reportedly due end of January.

Just this morning, The Information shared data on the declining revenue story at Twitter in Q1 2023:

Twitter’s fourth quarter revenue fell about 35% to $1.025 billion. That was 72% of Twitter’s internal goal for the quarter.

On Tuesday night, a senior Twitter manager told employees that the company’s daily revenue on Tuesday was 40% lower than the same day a year ago.

This is their ad business.

For subscriptions, it doesn’t take a product savant to tell you that Twitter Blue (their subscription offering) is half baked and lacks a killer feature to convert the mainstream users. Our revenue team at Tinder would have deprecated half the subscription offering by now.

Twitter continues to raise subscription prices now charging $11/month for Twitter Blue. They have likely identified a small cohort of relatively price insensitive subscribers (i.e. Twitter minnows and whales).

But pricing tests will only take the revenue team so far and subscribers will feel squeezed if they continue raising prices.

Maybe one day Twitter will embrace being the most dominant web2 social company for crypto and web3 — and build products for a cultural movement that has lived on its platform since that Hal Finney tweet in 2009.

Until then, Twitter and crypto are stuck in an awkward relationship.

Twitter leadership doesn’t want to be in a serious relationship, and Crypto Twitter isn’t leaving.