Failure happens in technology. Just ask Mark Twain.

I’m reading eBoys: The First Inside Account of Venture Capitalists at Work this weekend. The book is a fascinating account of how Benchmark became one of the top venture capital firms in the world in the late 1990’s, while taking a deep firsthand look at their investment in eBay.

The value of eBay grew from $20 million to more than $21 billion within two years of Benchmark's investment, an increase of 100,000 percent. Business Week called it "probably the best venture capital investment of all time."

One of the most interesting quotes of the book spoke about how a young investor at a rival firm named Steve Jurvetson (Draper Fisher Jurvetson) observed failed entrepreneurs who were never able to bounce back after shutting down their startups.

Steve’s wife was a therapist and worked with many of these entrepreneurs who never recovered, despite the fact that failure is generally pardoned in Silicon Valley.

The book astutely notes that failures in technology have existed for a long time and talks about author Mark Twain’s failed angel investment, which changed the course of his writing career and financial life:

Unable to resist investing in the high-tech sector of his day in the late nineteenth century, Mark Twain was financially ruined by his irrationally hopeful investments in the infamous Paige Typesetter; heavily in debt, he had to flee to Europe, where it took ten years before he could return with his family, recovered and solvent.

I started to research Twain’s failed investment more, as it struck me as odd that a non-fiction author raised in Hannibal, Missouri who was most famous for writing The Adventures of Huckleberry Finn was also a technology investor in 1880.

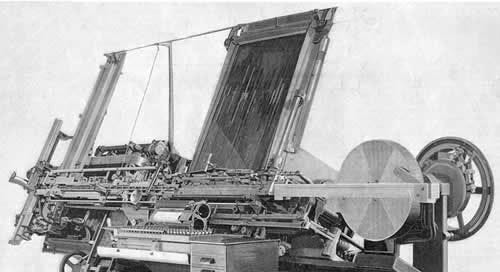

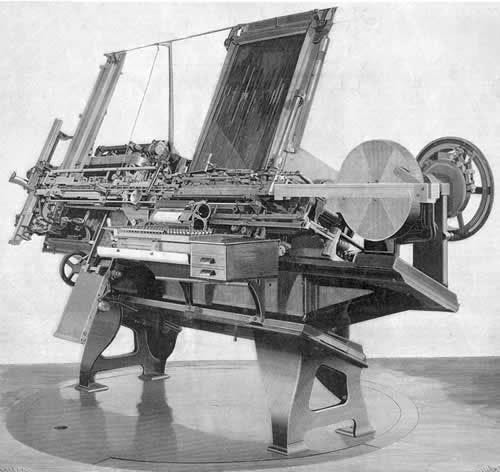

I found that the Paige Compositor was an automatic typesetting machine that Twain believed would revolutionize the publishing industry and that he invested $300,000 into at the time (now worth $6,000,000). He thought the product would enable faster and more efficient printing, and he put his family at great financial risk to invest in the startup.

The founder, Mr. James Paige, was known to be a perfectionist and spent 14 years building the product before he was ready to release the machine. By then, competitors emerged with products that were more efficient and less expensive.

After the failed investment, Mark Twain’s writing style even changed. Readers observed that he lost his wit and humor after suffering a catastrophic financial loss.

As a warning to other investors, Twain later recalled that he learned two lessons from his failed angel investment:

1. Not to invest when you can't afford to.

2. Not to invest when you can.

If you work in technology long enough, you will experience failure along the way. Failed product launches. Failed startup investments. Failed career decisions.

I have certainly failed many times throughout my career, but I’m lucky that I’m still productive after many challenging experiences at startups.

Bouncing back from failure is not a given.

I’ve observed former teammates at past companies leave the technology industry altogether after riding the startup roller coaster for too long. Some of us recover and others don’t.

Just ask Mark Twain, who lost his investment. And his sense of humor.

—

You are receiving the Chapter One Journal because you signed up for Chapter One updates or emails from me in the past. Looking ahead, I’m going to be sending more frequent thoughts on technology, venture capital, and product development and hope that you find the emails to be valuable and worth your time.

I will always do my best to provide information that is worth reading, as I know you are busy and have many other things you can do with your time. -Jeff Morris Jr.