Getting Hit By The AI Lucky Truck

Excerpts from our Limited Partner Letter - Fund One, March 2023

I wanted to test the idea of “open sourcing” Chapter One limited partner letters because these notes often contain my most lucid thoughts about what is happening in technology.

The letter has been abbreviated to remove confidential information and provides an insider view on how AI is accelerating companies within our Fund One portfolio.

I will do my best to continue sharing “insider” content with you. I find this writing to be more interesting as a reader because it’s a peek behind the scenes. Hopefully you find these products interesting and give them a try.

Our first fund was a $9.2m solo GP effort which I invested starting in August 2019 over the course of two years. We had ~50 portfolio companies focused on a combination of consumer, infrastructure, and crypto.

The world changed dramatically during this fund and continues to evolve as the portfolio matures. We survived Covid, the bull market, the bear market, and are now in a banking crisis.

But AI is giving the startup world optimism. The best part is watching everyone tinker with software again, like we’re all stuck in a 1980’s Palo Alto garage. That garage is Twitter, where our timelines have become nerdy GPT-4 prompts. The moment feels very futuristic and nostalgic at the same time.

Yes, AI can be scary, but the feeling right now is innocent, like we all woke up on Christmas Day and opened a new toy at the same time. And with the gloomy macro situation, tech layoffs, and a chaotic world - we deserve this moment of fun.

Chapter One, Page One LPs:

I write a shorter and more conversational update this month, following the most chaotic weeks of many of our careers. You’ve already received the Silicon Valley Bank update, so I wanted to shift gears and update you on the Page One portfolio.

Many of you have asked my thoughts on artificial intelligence in the past few months.

With the announcement of GPT-4 last week and no shortage of buzz in the media, rather than pontificate on the subject, I wanted to share a few AI-related developments in the Page One portfolio to help you understand how this is impacting the startup ecosystem.

The companies in Page One who are effectively using AI today have spent years building amazing products.

AI is supercharging growth and revenue, as consumers are eager to pay for AI at the application layer for products they already love. The common narrative right now is that AI value will accrue to OpenAI and big tech, but the less spoken narrative is that early to mid-stage startups applications are already seeing growth.

For the most part, our portfolio companies who are seeing the benefits of AI advancements did not start with AI on day one, but rather as product organizations focused on solving problems for customers including engineers, designers, writers, and creatives.

Their early technical moat is not data, but rather that their core products and cult user bases cannot be easily replicated. As the well-justified AI hype cycle continues, we’re afforded a unique insight into the timeless power of strong products and moats that span beyond proprietary data sets.

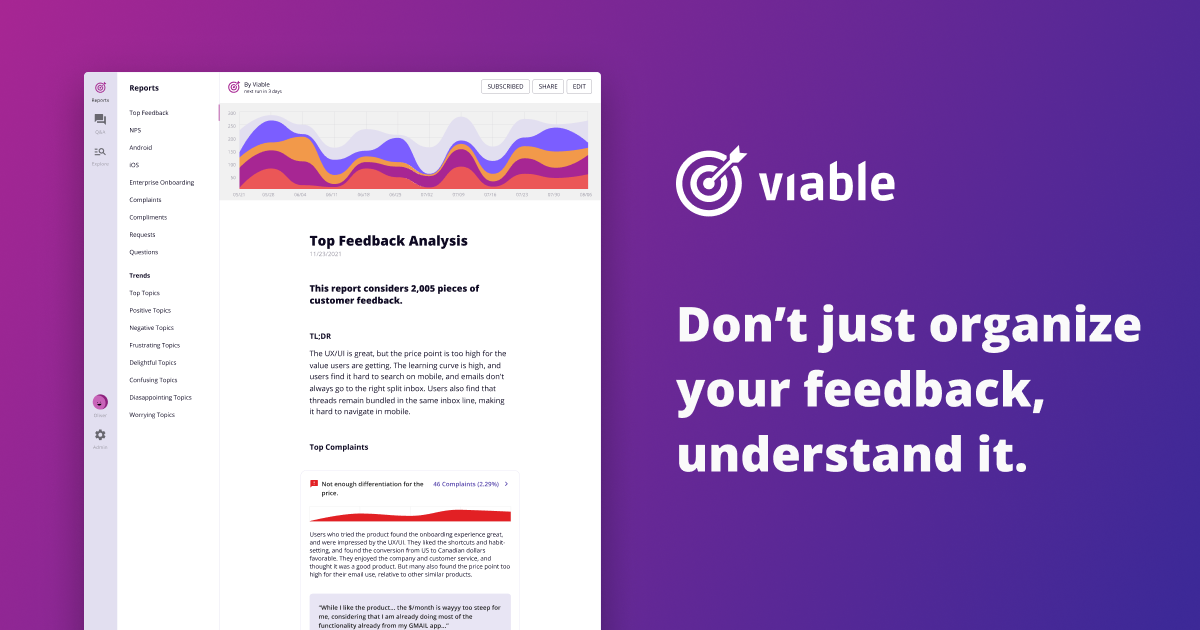

A few products from Page One that come to mind are Raycast (productivity software for developers), Tome (generative storytelling software that replaces Google Slides), Captions (auto subtitle and edit videos), Hyperwrite (write faster and sound smarter), and Viable (automated qualitative data analysis)

Raycast

Raycast has built the most beloved developer productivity software in the market today. We funded the company in Q1 2020 and they have spent almost 3 years building the product before adding AI. ChatGPT is built directly into the product, allowing developers to ask questions, automate workflows, and code faster.

One qualitative insight that I found interesting happened over the weekend. I was traveling on a work trip in Lake Tahoe with an engineer friend who happens to be a diehard Raycast fan. I questioned whether the AI features would monetize at the application layer.

He said he would pay Raycast for their AI features before subscribing to ChatGPT Plus because he uses the Raycast everyday in his developer workflow rather than visiting OpenAI - and has an emotional product to the product.

I assume he will pay for both Raycast and ChatGPT Plus over time, but this conversation gave me confidence that applications will benefit immensely in both DAU/WAU/MAU and revenue growth.

Tome

Tome has built a widely-adored storytelling product that we initially funded in 2020 & recently announced a $43m Series B led by Lightspeed after raising their seed round from Greylock with Reid Hoffman joining the board. The team has recently integrated AI for generative presentations, offering a seamless and effortless way for users to generate rich, engaging narratives and context-driven content pages.

With Tome at their fingertips, users need only enter a prompt to leverage the platform's powerful capabilities as it spins up intricate storylines, images and supplementary content pages at the click of a button. Tome is the fastest-growing productivity company ever to reach 1M users, according to Michael Mignano (Lightspeed).

Captions

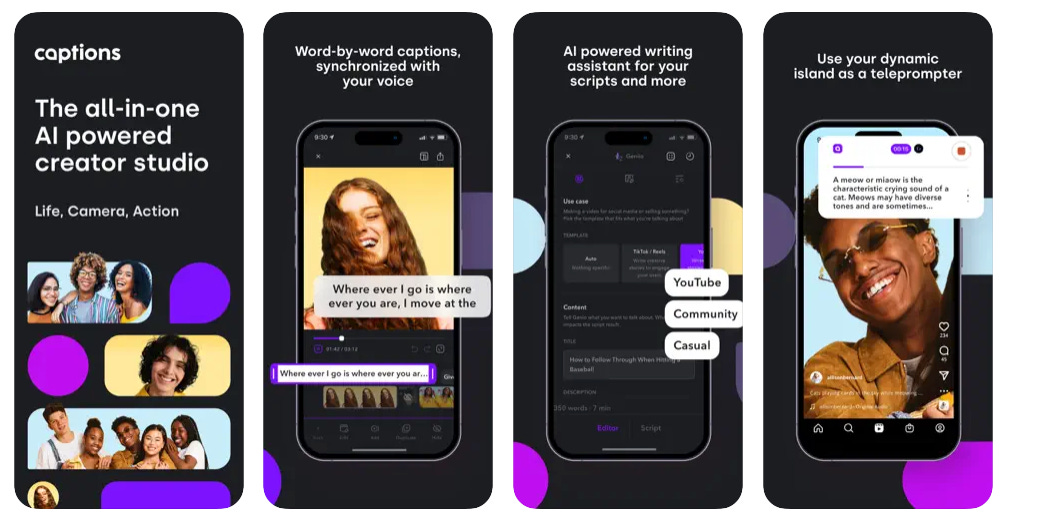

Captions is the only camera and editing app that lets you record, caption, customize, clip and share all from one app. As a smaller check, we helped fund the company in 2021, and they’ve gone on to build a remarkable product.

In addition to user-obsessed features like post-recording eye contact adjustment and universal caption translation, the team has more recently integrated AI into the product in the form of a script-writer and idea generator, helping creators perfect their tone with smart tips based on audience and category.

Hyperwrite

Hyperwrite is an all-in-one writing assistant that helps you write more quickly, creatively, and efficiently from idea to publication. Hyperwrite was one of the first startups to have direct access to OpenAI data in 2020 when we invested.

The team has built an outstanding product, with features like autocomplete, re-write, and auto-write now being powered by GPT-4 and adapting to your personal writing style. You can learn more about HyperWrite AI here:

Viable Fit

Viable is a customer feedback analysis platform that empowers businesses to better understand their customers and make data-driven decisions. Viable has been an AI-first company since our original investment.

Having seen rapid growth and an expanding, ever-enthusiastic userbase, Viable has emerged as a market leader in harnessing the power of natural language processing and artificial intelligence for customer feedback.

By leveraging AI, the platform processes vast quantities of unstructured customer data, transforming it into actionable insights that enable businesses to optimize their strategies, enhance customer satisfaction, and drive growth.

Despite the broader tumult of the last few months we’re quick to remind ourselves that there’s no better time to be investing in early stage venture.

A key learning from Page One is that portfolios mature in unpredictable ways and platform shifts like AI can accelerate your portfolio several years into a fund cycle.

Mike Maples (Floodgate) once told me that in early stage investing you have to put yourself in a position to “get hit by the lucky truck” and I believe that recent AI advancements might be that lucky truck moment for investors who deployed in product-first companies in the late 2019/early 2020 vintage.

It’s no secret that many of the greatest companies are started in less than favorable conditions, and we believe remaining level-headed, disciplined and patient in our approach will be key to our success. As always, our commitment to you is to convey updates, both positive and negative, with absolute clarity.

We continue to hold the utmost conviction in our portfolio and maintain our belief in the success of Page One.