Stablecoin Volumes - Now Exceed Mastercard, American Express and Discover

On-chain stablecoin volumes exceed volumes processed by Mastercard, American Express, and Discover. But web3 has no use cases?

A common question I hear when talking about web3 friends, venture capitalists, and limited partners — is whether there are use cases beyond financial speculation.

The tone of the conversation often has skepticism, which I understand given the negative headlines in 2022.

The purpose of my recent writing is to provide a measured, data-driven approach to what is actually happening in technology and web3 right now, because the current mainstream narrative is mostly negative.

This week, I listened to Empire, a podcast by Blockworks — “10 Investment Themes from Brevan Howard | Colleen Sullivan, Peter Johnson”, which did a wonderful job putting current stablecoin data in perspective.

The use of stablecoins to move dollars around the world continues to be the quiet killer web3 application. On-chain stablecoin transaction volume, which does not include off-chain trading at centralized exchanges, is already at ~$9tn in annualized run-rate.

On-chain stablecoin volumes now significantly exceed the volumes processed by Mastercard (~$2.2tn in 2021), AmEx (<$900bn in 2021), and Discover (<$200bn in 2021).

In 2023, on-chain stablecoin volumes will grow to well over $15tn, outpacing volumes at the largest card network, Visa, which processes ~$12tn in annualized volume.

We predict that on-chain stablecoin volumes will not only surpass Visa volumes, but will also likely surpass the aggregate volume of all four major card networks.

(What To Expect for NFTs and Digital Goods in 2023, Blockworks)

Mastercard ($360.62B market cap), American Express ($115.43B market cap), and Discover ($29.17B market cap) represent $505.22B of enterprise value in terms as combined market caps.

What’s more amazing is how quickly stablecoin adoption has happened.

For perspective, Mastercard was founded in 1966, American Express was founded in 1850, and Discover was founded in 1985 — these organizations have been around for a combined duration of 265 years.

The most dominant stablecoin USDC was created about 4 years ago in September 2018. It’s wild to see a technology innovation gain this much adoption in such a short time period, and the transaction volume continues during the bear market.

Who is the big winner in the stablecoin market right now?

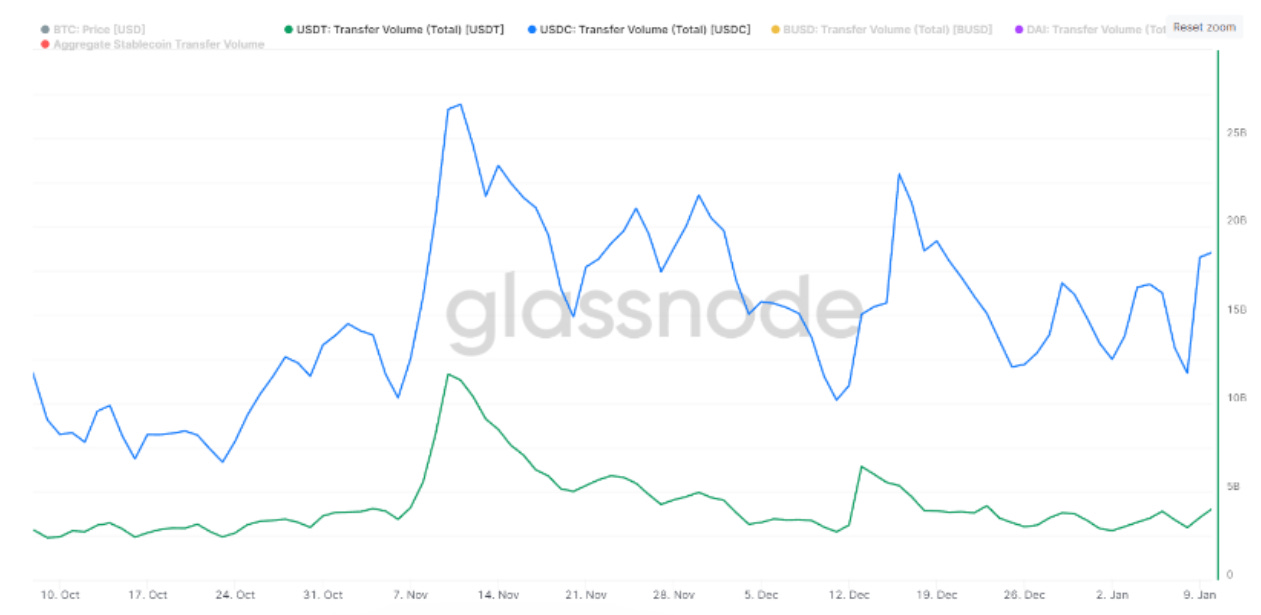

USDC (blue line in graph below) currently has 4.5x the trading volume of its nearest major competitor Tether (green line in graph below) — and has been trading $15-$20b a day during the bear market.

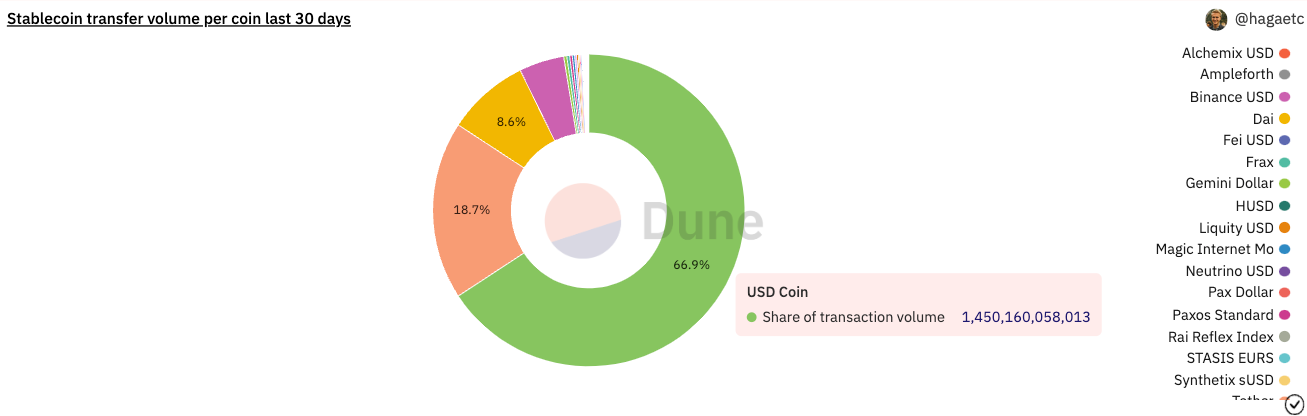

USDC represents 66.9% of stablecoin transfer volume over the last 30 days, which is remarkable considering Tether (USDT) has a market cap that is $23B greater.

I realize that some readers might be asking the question “what is a stablecoin?” — and there is already a lot of great content out there to explain use cases.

The stablecoins I am referring to are fiat backed and are often used in emerging or developing countries like Argentina, Nigeria, Turkey, and Ukraine to easily transfer money and provide safety from hyperinflation.

I’ll borrow an explanation from Coindesk to make life easier and we can dive into more use cases in a follow up piece if there is interest (feel free to respond to this post directly if you want this content):

A “stablecoin” is a type of cryptocurrency whose value is pegged to another asset class, such as a fiat currency or gold, to stabilize its price.

Cryptocurrencies such as bitcoin and ether offer a number of benefits, and one of the most fundamental is not requiring trust in an intermediary institution to send payments, which opens up their use to anyone around the globe.But one key drawback is that cryptocurrencies' prices are unpredictable and have a tendency to fluctuate, often wildly.

This makes them hard for everyday people to use. Generally, people expect to be able to know how much their money will be worth a week from now, both for their security and their livelihood. (Coindesk, Alyssa Hertig)

One unique feature of blockchains (which is every data scientists dream) is every project has publicly available data for on-chain transactions. Dashboards have often been created by the community free of charge on platforms like Dune Analytics.

If you have energy and curiosity, you can analyze what is happening in the ecosystem at any moment, rather than relying on the media or Twitter.

In web2, this would be the equivalent of being able to view any startups data dashboards in real-time. You can do this in web3.

The lesson I keep learning in this bear market is to ignore mainstream headlines, follow the data, and do my own research. This applies to all areas of life.

If you want to learn about stablecoins through data, I recommend the Stablecoins dashboard by @hagaetc (co-founder of Dune Analytics)

Thanks for this nice article.

Couple of thoughts

a) Institutions use stable coin to move money and typically these are high volume transaction amounts. Comparing (Retail + Institutional) Volume of stable coin to retail transaction volume of card networks is an apples to oranges comparison.

b) Some of the stable coin volume is to invest in stable currencies such as USD. This is an investment use case instead of a money movement use case.

At the same time I want to acknowledge that these 2 points above does not negate the main thesis of this article and I agree with.