Venture narrative whiplash is a phenomenon I am coining that birthed from the ever-evolving discourse on Twitter, and has transformed the venture capital landscape over the past decade more than any other phenomenon that I can identify.

Social media platforms like Twitter were once water coolers for founders, general partners and limited partners to discuss emerging narratives, and they have become “told-you-so” forums for finger-pointing debates on what is real versus hype.

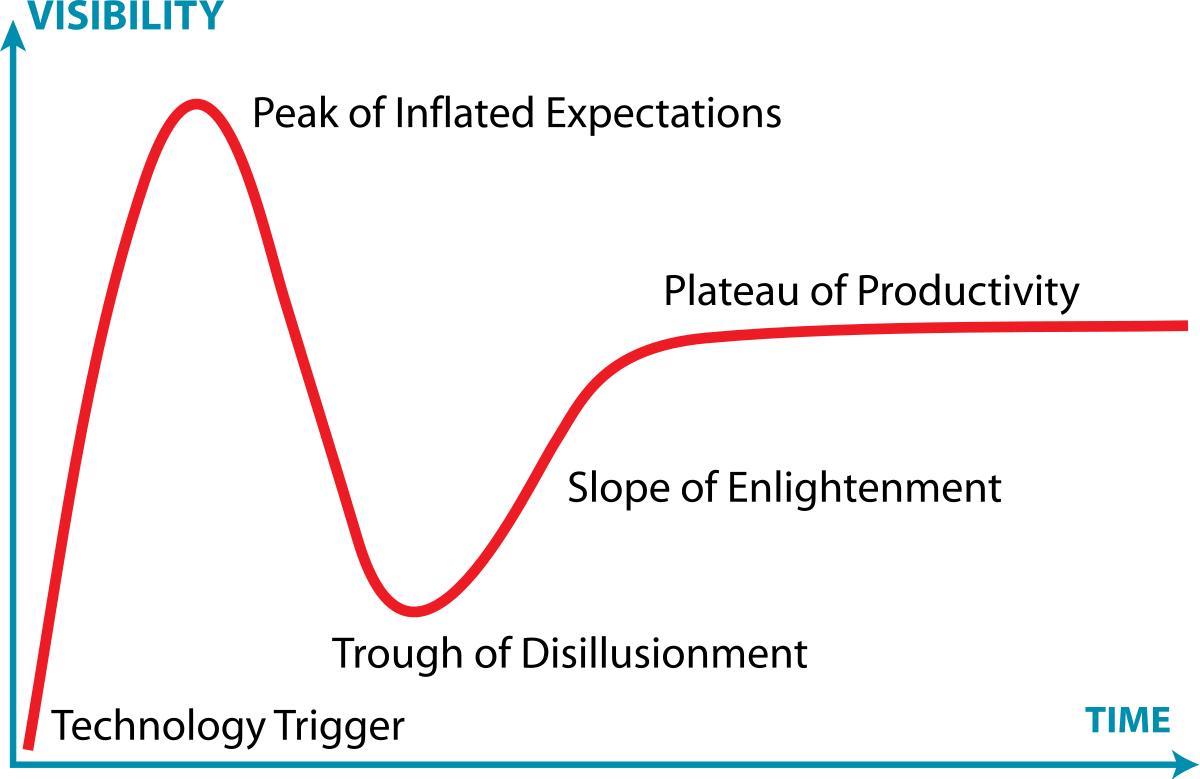

New technologies are known for nonlinear progression, peppered with false starts before achieving breakthroughs. The trough of disillusionment (seen below) is a well understood framework that states that emerging technologies move through different stages.

These stages used to happen in relative silence. Founders in their proverbial garages worked on solving hard problems and a finite group of Sand Hill venture capitalists could track innovation over breakfast at Buck’s in Woodside. The discourse was insular and contained, which allowed time and space for technical progress.

Today, each morning brings new tech narratives that question the validity of the software and hardware that we build each day.

Venture capitalists are now media companies that need fresh stories to tell. It’s like we’ve all become our own tech focused versions of TMZ.

This whiplash trickles down to founders—the architects of innovation— which impacts the companies that get built every year.

The blockchain ecosystem witnessed a violent venture narrative whiplash in Q3 2022.

Look no further than Y-Combinator for a barometer on the venture narrative of any given cycle.

The YC Spring 2022 cohort had 22 blockchain companies. The Spring 2023 cohort has only 3 blockchain companies, representing a 86% YoY decrease in a single year.

By our math, over 50% of the Spring 2023 batch has an “AI” story in their pitch, which certainly wasn’t the case in Spring 2022.

Even so, blind AI hype appears to have peaked and reached its own momentary Trough of Disillusionment (shown below), where investors realize that GPT wrappers might not be venture scale companies and every foundation model might not justify billion dollar rounds.

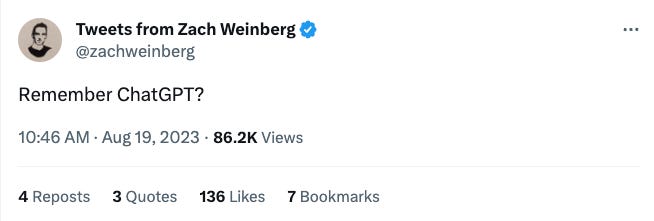

Witness the AI venture narrative whiplash over the past few weeks on Twitter and the news, and think about where the narrative might land in a few months — after a few companies who raised billions of dollars blow up and industry voices have their “told you so” moment.

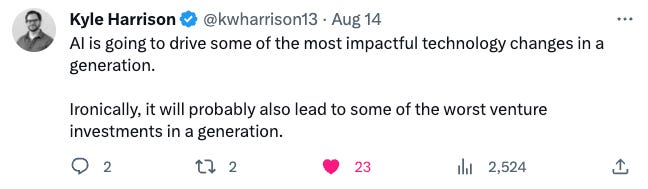

Right or wrong, AI whiplash is just beginning and will become consensus soon:

Truth lies between extremes and there are opportunities for investors who resist blind adherence to market fluctuations.

Remember, venture capital funds operate within a ten-year time frame that sees multiple cycles of technological favoritism ebb and flow.

True contrarian investing is an active decision to avoid venture narrative whiplash on a daily basis by focusing on underlying technical progress and consumer adoption.

And that is what we are doing today.

Well said, Jeff