When Facebook Tried To Kill Tinder

A firsthand perspective on waking up to find out Facebook is your new competitor - and how X must feel right now.

While the world eagerly anticipates Mark Zuckerberg and Elon Musk's Coliseum fight, the true battle has already been fought between Threads and X.

Take a stroll down memory lane with me.

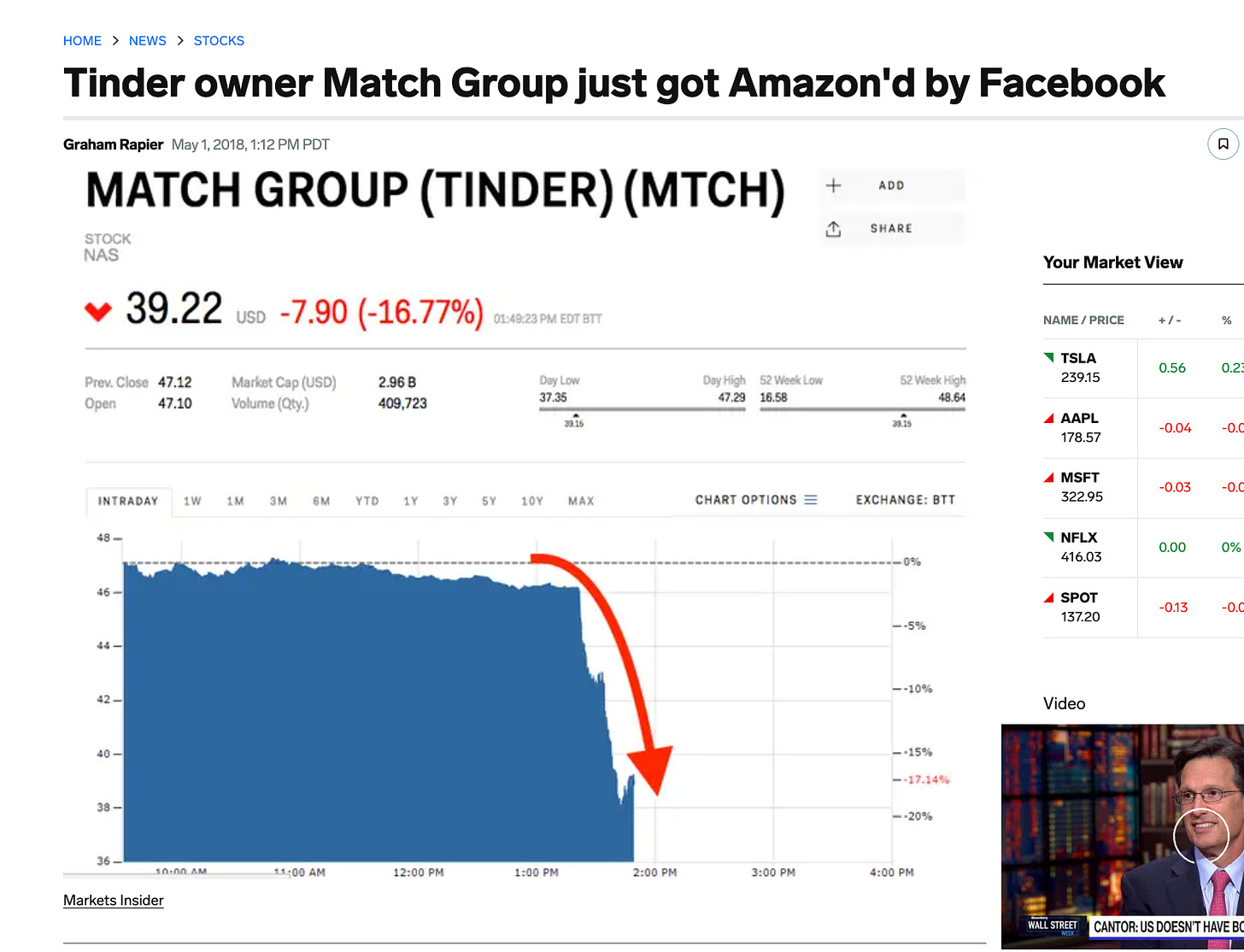

I was part of the Tinder team when Facebook decided to enter the dating market. We were caught off guard, and the market strongly reacted. In one swift blow, our stock plummeted by more than 20% during a single trading day.

Imagine a bunch of engineers and product people sitting at their computer screens together, scared shitless, as their hard earned equity came crashing down.

That was Tinder on May 1, 2018.

Tinder had a very friendly relationship with the Facebook team and they gave us no warning, so the proclamation of war caught us off guard. But we weren’t unprepared.

We were using Facebook Connect infrastructure to authenticate users at the time — which was a major part of our product strategy. Facebook Login is what was populating most of our user profiles with photos and biographies in a single tap.

Many people including our founders used to say that “Facebook Login” was as important to Tinder’s success as the swipe because it felt so effortless to create a profile and users felt like they were joining a social app, rather than a dating product.

Luckily, we predicted that Facebook might one day try to beat us and prepared for this war.

Internally, we built an alternative authentication flow which we could switch to if we needed to abandon Facebook altogether. Some of this was more luck than skill, as the primary reason for building this alternative authentication experience was cost related, as we had concerns Facebook would squeeze us on API pricing one day.

We also had concerns over Facebook having access to our user data which could help them accelerate a dating product launch if we ever became competitive.

Either way, we were ready for the “Facebook is building a Tinder competitor” moment, but when you face an unannounced attack like this on a random morning in May, you are still caught off guard.

The ensuing hours were a blur of doubt, worry, and contemplation - a crisis room during a modern digital war. Was Facebook going to kill Tinder?!

The answer was no.

Within months, we realized that Facebook Dating was not going to work. The data showed that the product wasn’t taking off and the dating product was impossible to discover amongst a menu of competing Facebook products.

We found that many users would start their online dating journey on Facebook, get over their embarrassment of being an “online dater”, and join Tinder instead - so Facebook actually grew the market in our favor.

In the end, the public markets had greatly overreacted and we beat Goliath. If you bought MTCH in May 2018 and took some gains over the next few years, you probably made lots of money (see below). Victory!

One question that I often get from founders — how did we feel after surviving Facebook? Waking up to news that Facebook is your newest competitor is a nightmare for almost every consumer founder, so I understand the curiosity.

The easy answer is we felt invincible coming to work everyday. We had survived our greatest threat.

We don’t have championships in tech, but if there is a championship to win as a consumer company, beating Facebook in your own market is the trophy you want to win.

Imagine the the nerdier version of the 1990’s Chicago Bulls walking through the tunnel with the The Alans Parson Project “Sirius” blasting on the United Center speakers. That was Tinder HQ in 2018.

Fast forward to Q3 2023.

X, formerly known as Twitter, must be reveling in a similar triumph.

Threads, which just months ago threatened to compete with Elon’s wounded social media platform, has seen its daily active users take a nosedive, down by 80%+ in just three weeks.

Data on Meta’s Threads indicates that daily active users are down 82% from the app’s post-launch high, to just 8 million users (vs 44 million), one month after launching to record growth.

The decline in usage can likely be attributed to the fact that it simply lacks basic functions many users long for.

The platform still omits a search function. And, most importantly, it fails to support desktop functionality.

No doubt that Threads has a long roadmap to go. And to be clear, I would never count Facebook out.

But DAU declining by 82% isn’t just a number; it’s a statement. It signifies the early battle has been lost for Facebook, and more importantly, that X has real staying power.

For the employees left at X, the past months must feel like a huge victory after a year of absolute chaos.

X will have renewed vigor to be more aggressive with their roadmap. We know that Elon has aspirations of building an “everything app” and that will happen over the next year (hopefully “everything” except for dating).

We will see new experiments with payments, ads revenue sharing, and much more. And this will be exciting compared to Twitter of past years.

Elon isn’t in a hurry to fight Zuck at the Coliseum.

He already won the first fight.

Do you think Tinder's successful triumph over Facebook made it complacent over the last few years?